Steering shipping clear of financial crime risks with technology and alliances

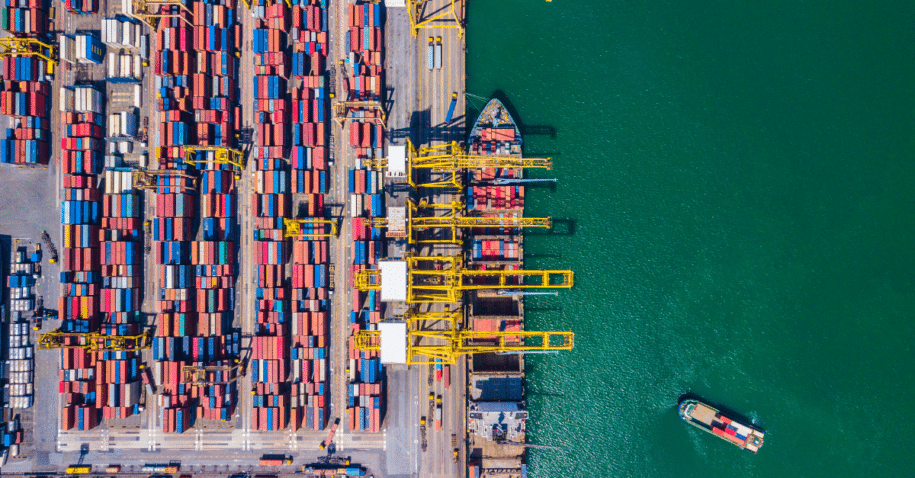

Shipping is a core part of the global economy, but it, like much of trade, is hampered by inefficient processes and financial crime risks. Alliances and intelligent technologies are emerging to digitize and standardize maritime trade documents to steer clear of potential non-compliance.

International shipping is the life blood of trade and the global economy, with more than 80% of merchandise goods by volume carried by sea.

One of the most important documents in shipping is the bill of lading (BL), which is issued by a carrier to a shipper and details the type, quantity, and destination of the goods being transported. The BL, as with many documents and processes in trade and trade finance, has largely been issued in a paper format for hundreds of years.

Because of the decentralized nature of trade, and jurisdictions legislating different rules, trade documents vary wildly in quality and complexity. This, along with the manual compliance processes used to inspect trade documents including BLs, has made shipping and trade susceptible to financial crime risks.

Criminal organizations are using maritime trade to launder illicit proceeds by manipulating documents and vessel location signals, with manual compliance processes failing to identify risks effectively.

This inefficient method of due diligence is made worse as compliance and financial crime prevention processes, for example sanctions screening, container tracking and dual use goods identification, are typically completed separately and do not take a holistic view of wider illicit networks that may cross over the different aspects of compliance.

Navigating alliances

An important part of improving compliance and financial crime prevention in shipping and trade is standardizing the data in documents ready for inspection.

In an effort to facilitate the use of standardized digital documents, specifically the electronic bill of lading, the International Chamber of Commerce, shipping bodies and Swift launched the Future International Trade (FIT) Alliance this month.

The FIT Alliance aims to generate awareness about the importance of common and interoperable data standards and common legislative conditions across jurisdictions. The group’s goal is to facilitate acceptance and adoption of an eBL by regulators, banks and insurers, and to unify communication between these organizations and customers, physical and contractual carriers, and all other stakeholders involved in an international trade transaction.

While this is a welcome development, to drive widespread acceptance and adoption of an eBL will require a monumental effort by industry, banks and regulators – and one that seems unrealistic in the short term. Indeed, the eBL has been around for decades and is yet to be embraced by many stakeholders across trade – it represents a fraction of BLs in circulation. Many jurisdictions simply do not recognize the eBL as a document with legal standing.

Transforming trade

Nevertheless, players in trade must move forward with digital transformation if they are to improve efficiency, as well as reduce risk, costs, and keep up with the increasingly strict regulatory environment.

For those reasons, bottom-up solutions that leverage intelligent technologies and can be utilized today will be central in digitizing and standardizing data in trade. For example, TradeSun’s platform, powered by unique AI Astra technology, classifies documents, extracting and standardizing data from structured and unstructured documents to the highest degree of accuracy.

The platform then performs multiple due diligence activities in real-time, taking a holistic view across the different elements of compliance, from sanctions to trade-based money laundering. Importantly, robust reporting, audit trails, and prescriptive analytics are provided across the platform.

Shipping is central to the world economy, but it, like much of trade, is plagued by inefficient processes and financial crime risks. Alliances to standardize digital trade documents, such as the BL, are encouraged, but unlikely to drive widespread adoption and acceptance in the near term. Bottom-up solutions offer a way to transform trade processes today, which will be crucial for industry’s evolution.