ESG is here to stay with regulation ‘top of mind’

Despite differing views on environmental, social and governance – or “ESG” – matters, pressure by regulators over such topics is apparent, and rising around the world, writes the TradeSun team.

Environmental, social and governance continues to be hotly debated by the global business community and beyond.

“Regulators around the world are upping the ante on everything from greenwashed fund names to stricter climate target disclosures, while the very idea of ESG investing is increasingly politicized,” stated MSCI, the investment researcher, in its ESG and Climate Trends to Watch for 2023 report last month.

Despite differing views over ESG as a topic, the rising pressure by regulators on companies over such matters is apparent. The action taken in the past few years has started to shape investment decisions as well as the challenges and opportunities facing companies in all territories.

Indeed, MSCI added that regulation is now “top of mind not just in the EU, but increasingly in the US and APAC markets from requirements for financial institutions to conduct climate stress tests, to deforestation-free market-access rules”. The researcher said close attention was also being paid to ESG-related supply chain issues.

As the highest-level frameworks set by global leaders – such as the UN Sustainable Development Goals and the Paris Agreement – to better people and planet trickle down into national policy across markets, ESG is now a matter of compliance.

Far and wide

Europe is widely considered a leader in implementing ESG-linked policies as well as advancing more sustainable business practices, with the introduction of the EU Taxonomy in 2020, and more recently the Corporate Sustainability Reporting Directive last month.

However, as MSCI points out, other regions are fast carving out their own rules, particularly regarding climate risk. In North America, for example, the US Securities and Exchange Commission’s proposed climate-related disclosure for public companies is set to be finalized in April, while various guidelines for ESG funds are being circulated across Asia, including in Hong Kong and Australia.

Additionally, in January, the US Federal Reserve told the six largest US banks to assess data on how their businesses would be impacted by climate change and the transition to a lower-carbon economy.

The pilot, according to the Fed, is to learn about large banking organizations’ climate risk management practices and challenges, including estimates of how lending might be affected by the transition to a net-zero carbon economy by 2050.

Climate stress test

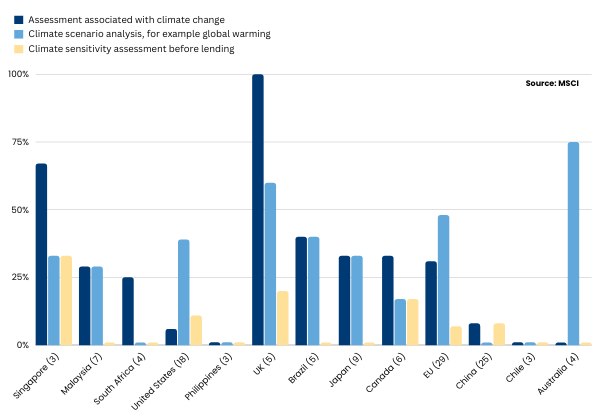

Understanding and measuring the exposure of global banks’ balance sheets to climate-related risks is likely to impact lending decisions. According to MSCI, in at least 18 jurisdictions, banks already are or soon will be subject to regulatory climate stress tests.

Banks’ performance on disclosed climate risk analysis indicators

The x-axis shows jurisdiction and the number of banks included in the study. The analysis shows the % of banks disclosed as having conducted climate risk analysis in each of the three categories in a selected jurisdiction.

While banks in some jurisdictions are implementing climate stress tests, many are still not, as the chart shows.

Turning to tech

The sharpening focus on ESG means that accurate reporting – without bias or greenwashing – is playing a pivotal role across banks and business.

One way businesses can build a more objective and accurate picture of their ESG risk is with technology. The market understands this, with nearly all companies expecting to invest in ESG reporting technology over the next year, according to a recent report by consultancy Deloitte.

Automated ESG scoring, for example, can support better management of ESG and climate risks for banks and businesses. Intelligent tools, such as the CoriolisESG scoring solution, facilitate transparency by measuring ESG impact throughout all supply chain tiers, mapping entities and their activities against recognized frameworks.

Improvements in sustainability can only be productive when measured in an independent, standardized, and scalable manner. Technology will be key to ensuring adequate measuring of ESG risk and, therefore, advancing sustainability for business and beyond.

Ultimately, as regulatory action over ESG increases around the world, businesses need ways of connecting national policies and high-level frameworks to their everyday activities – real solutions that work on the ground, if sustainability goals are to be met.